Have you ever felt like you’ve spent your life savings on endeavors that didn’t pay off as you hoped? You’re not alone. Many individuals find themselves at a crossroads after significant financial setbacks, whether from poor investments, unexpected expenses, or even job loss. In times of crisis, the support of a skilled life coach can make a tremendous difference. In this article, we will explore how life coaching can help you regain control over your life and finances after spending your life savings.

Understanding Spent Life Savings Life Coaching

Spent life savings life coaching focuses on guiding individuals who have experienced financial loss. This specialized type of coaching aims to help clients rebuild their lives, reassess their goals, and create actionable plans moving forward. The coaching process can address emotional, practical, and psychological aspects of financial recovery.

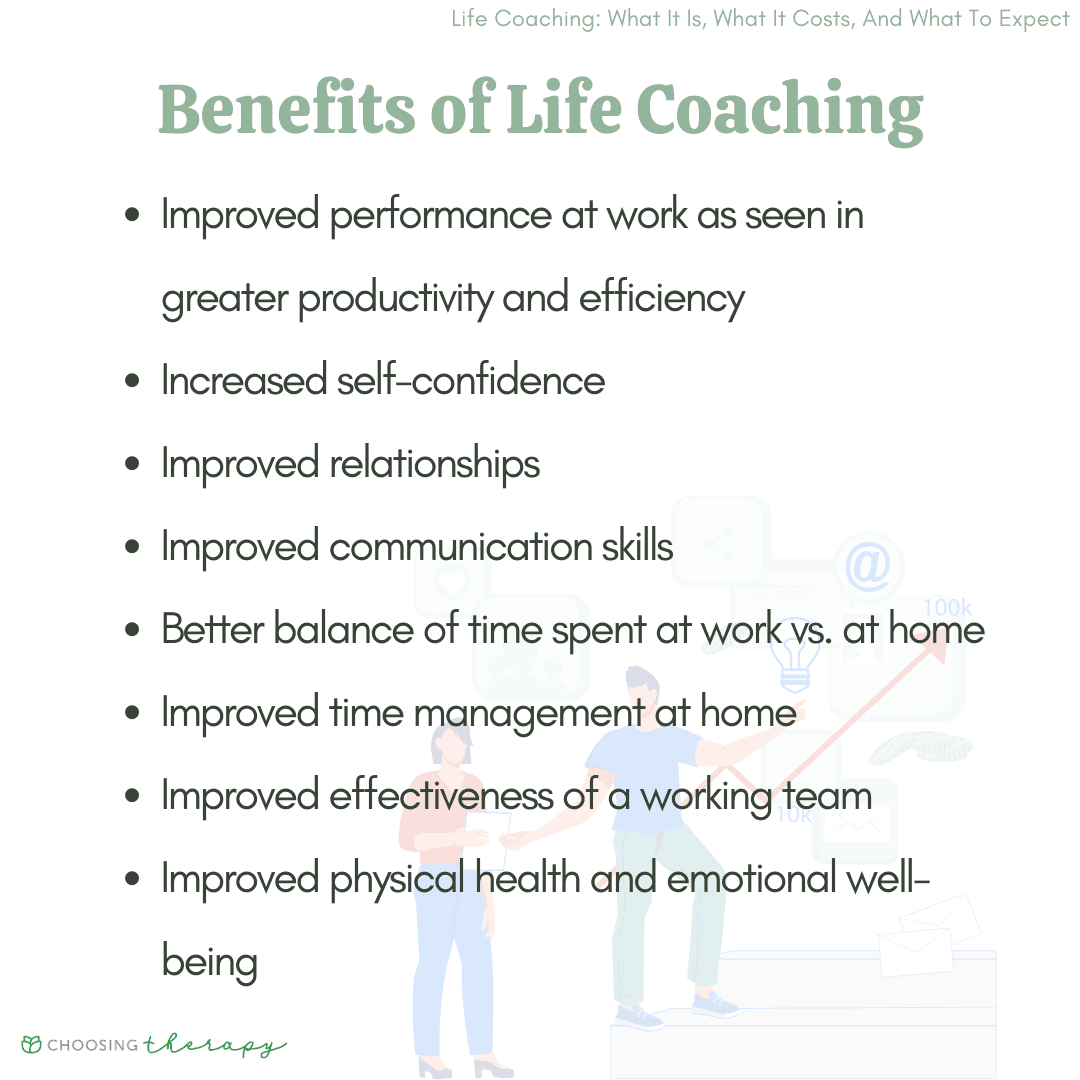

The Importance of Life Coaching

- Emotional Support: A life coach provides the emotional support needed during tough times, helping individuals navigate their feelings of loss and uncertainty.

- Accountability: Coaches keep clients accountable to their goals, ensuring they stay on track as they work toward financial recovery.

- Goal Setting: Coaches assist in setting realistic and achievable goals that align with the client’s values and aspirations.

Types of Life Coaching Services Available

In-Person Life Coaching

In-person sessions allow clients to build a personal connection with their coach. These sessions can be held at the coach’s office, a public space, or even in the client’s home. Pros and cons include:

| Pros | Cons |

|---|---|

| Personal interaction fosters trust. | Travel time and expense can be a barrier. |

| Immediate feedback in real-time. | Limited to local coaches. |

Online Life Coaching

With the growth of technology, online life coaching has become increasingly popular. Coaches and clients can connect through video calls, phone calls, or messaging apps. Here are the pros and cons:

| Pros | Cons |

|---|---|

| Flexibility in scheduling sessions. | Technology issues may disrupt sessions. |

| Access to a broader range of coaches. | Less personal interaction compared to face-to-face. |

Group Coaching

Group coaching sessions offer community support, allowing clients to share experiences and insights. This method can be beneficial for those looking for camaraderie during recovery. Here are the pros and cons:

| Pros | Cons |

|---|---|

| Shared experiences can reduce feelings of isolation. | Less individual attention from the coach. |

| Lower cost compared to individual coaching sessions. | May not be suitable for those seeking privacy. |

Platforms for Finding Life Coaches

Finding a life coach that suits your needs can be a daunting task. Several platforms can help connect clients with qualified coaches:

1. BetterHelp

BetterHelp is an online platform offering access to licensed therapists and life coaches. Users can filter by specialties, including financial coaching.

2. Noomii

Noomii is a coaching directory that allows users to search for life coaches based on location, specialty, and budget.

3. Life Coach Directory

This resource provides a comprehensive list of life coaches across various specializations, including financial recovery.

4. Coach.me

Coach.me offers online coaching and habit tracking, making it suitable for individuals aiming to change their financial habits.

How to Choose the Right Life Coach

Selecting the right life coach is crucial for effective recovery. Here are some steps to consider:

Understand Your Needs

Identify what specific areas you want to work on. Are you looking for help with budgeting, emotional recovery, or career changes?

Check Credentials

Ensure the coach is certified and has relevant experience. Look for certifications from recognized organizations, such as the International Coach Federation (ICF).

Assess Their Communication Style

Schedule a preliminary session to see if their communication style resonates with you. A good coach should make you feel comfortable and valued.

Read Reviews and Testimonials

Look for feedback from previous clients to gauge the effectiveness of the coach’s methods. This can often provide insight into their coaching style and success rates.

Common Challenges After Spending Life Savings

Recovering from the emotional and financial impact of spending your life savings can be challenging. Here are some common hurdles:

1. Emotional Turmoil

Feelings of regret, shame, and anxiety can emerge after significant financial loss.

2. Setting Realistic Goals

Clients often struggle to set realistic recovery goals following a setback.

3. Trust Issues

Past financial experiences can lead to distrust in investing, even in personal growth opportunities.

Leveraging Technology for Financial Recovery

Many apps and tools can support your financial recovery journey:

Budgeting Apps

- Mint: A comprehensive budgeting tool that connects to your bank accounts.

- You Need A Budget (YNAB): Focuses on proactive budgeting to help you regain financial control.

Financial Education Platforms

- Khan Academy: Offers free courses on personal finance, investing, and budgeting.

- Udemy: Provides inexpensive classes on financial literacy, aimed at various skill levels.

Mindfulness and Mental Wellness Apps

- Headspace: An app focusing on mindfulness and meditation practices to reduce anxiety.

- Calm: Offers guided meditations and resources to promote emotional well-being.

Success Stories: Real Examples of Recovery

Many individuals have successfully turned their financial setbacks into learning experiences:

Case Study 1: John’s Journey

John, a 45-year-old entrepreneur, lost his life savings due to a failed business venture. After engaging with a life coach, he re-evaluated his goals and developed a new, successful business plan focused on his passions.

Case Study 2: Sarah’s Transformation

Sarah, a single mother, faced significant debt after unexpected medical expenses. With the help of her life coach, she learned budgeting strategies that ultimately allowed her to pay off her debt and save for her children’s education.

Conclusion: Taking the First Step

Recovering from spending your life savings can be daunting, but with the right support, it is entirely possible. Life coaching can provide the tools and insight needed to regain control of your financial future. Whether you choose in-person, online, or group coaching, the key is to find a coach that resonates with you. Remember, the journey toward recovery starts with a single step.

FAQs About Spent Life Savings Life Coaching

What is the cost of life coaching services?

The cost of life coaching varies widely, ranging from $50 to $300 per hour, depending on the coach’s experience and the coaching format.

How long does it typically take to see results from life coaching?

Clients may begin to see changes within a few sessions, although significant transformations can take several months or even years.

Can life coaching guarantee financial success?

While life coaching can provide valuable tools and support, it does not guarantee financial success. It empowers clients to make informed decisions and take actionable steps toward their goals.

For more information and resources, consider visiting Annual Credit Report or reading studies on financial wellness from the Consumer Financial Protection Bureau.