Are you passionate about helping others achieve their financial goals? Becoming a financial coach might be the perfect career path for you. In this guide, we will explore what it takes to become a financial coach, the skills required, and the potential benefits and drawbacks of this fulfilling profession. Let’s dive in!

What is a Financial Coach?

A financial coach is a professional who helps clients improve their financial literacy, set financial goals, and develop actionable plans to achieve those goals. Unlike financial advisors, who often focus on investment strategies, financial coaches emphasize education and personal finance management.

Why Become a Financial Coach?

The demand for financial coaching has grown significantly in recent years. According to a Statista report, the financial coaching industry is expected to reach $1 billion by 2025. This growth presents an opportunity for individuals who want to make a positive impact while building a rewarding career.

Pros and Cons of Being a Financial Coach

| Pros | Cons |

|---|---|

| Flexible hours | Inconsistent income |

| Rewarding work | Requires continuous education |

| Growing market demand | Challenging clients |

| Opportunity for specialization | Limited initial guidance |

| Ability to help others | Requires strong self-marketing skills |

Steps to Become a Financial Coach

1. Understand the Role of a Financial Coach

Before diving in, it’s essential to know what a financial coach does. Financial coaches typically assist clients with budgeting, saving, debt reduction, and achieving financial goals. Developing a clear understanding of the role will help you frame your approach.

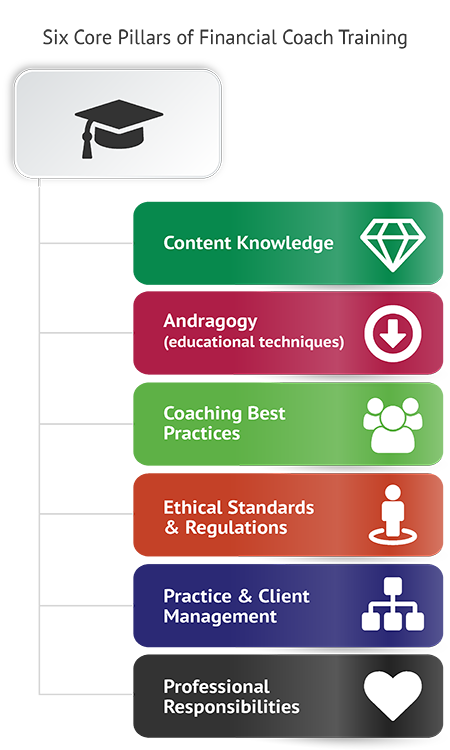

2. Pursue Relevant Education

While formal education is not mandatory, having a background in finance, business, or a related field can be beneficial. Here are some options:

- Degrees in finance, accounting, or business administration

- Certified Financial Coach (CFC) or similar certification programs

- Online courses in personal finance and coaching strategies

3. Develop Essential Skills

Core Skills Required

- Communication: Ability to explain complex concepts in simple terms.

- Empathy: Understanding clients’ emotions and financial stressors.

- Analytical Skills: Ability to analyze clients’ financial situations.

- Problem-Solving: Developing tailored solutions for clients.

- Marketing: Skills to promote your services effectively.

4. Gain Experience

Hands-on experience is invaluable. Consider volunteering or working with established financial coaches to understand their processes and gain practical insights. Additionally, you could offer free coaching sessions in exchange for testimonials.

5. Obtain Certification

While not strictly mandatory, obtaining certification can enhance your credibility. Some popular certifications include:

6. Establish Your Practice

Create a business plan outlining your services, target market, and marketing strategies. You can choose to work independently, join an existing practice, or even work online.

7. Market Your Services

Effective marketing can set you apart from competitors. Use various channels to reach potential clients, including:

- Social media platforms like LinkedIn and Facebook

- Your website or blog with valuable content

- Networking events and financial literacy workshops

Building Your Clientele

Finding Your Niche

Identifying your target market can significantly improve your chances of success. Consider specializing in areas like:

- Debt management

- Retirement planning

- Investing for beginners

- Family budgeting

Client Acquisition Strategies

Once you’ve established your practice, you’ll need strategies to acquire clients. Some effective methods include:

- Offering free initial consultations

- Leveraging referrals from satisfied clients

- Creating informative content that addresses common financial questions

Tools and Resources for Financial Coaches

Utilizing the right tools can simplify your processes and improve client interactions. Here are some recommended tools:

| Tool | Purpose |

|---|---|

| Canva | Design graphics for social media and presentations |

| Trello | Project management and organization |

| Zoom | Virtual meetings with clients |

| GoToMeeting | Web conferencing solutions |

| Hootsuite | Manage social media accounts |

Continuing Education and Networking

To maintain a competitive edge, it’s crucial to stay updated on industry trends and best practices. Attend workshops, webinars, and conferences related to financial coaching. Networking with other professionals can lead to valuable insights and referrals.

Networking Opportunities

Joining professional organizations can be a great way to network and continue your education. Some notable organizations include:

- National Foundation for Credit Counseling (NFCC)

- Association for Financial Counseling & Planning Education (AFCPE)

- Financial Planning Association (FPA)

FAQs about Becoming a Financial Coach

What qualifications do I need to become a financial coach?

While formal qualifications are not strictly necessary, having a background in finance or business, along with relevant certifications, can enhance your credibility in the field.

How much can I earn as a financial coach?

According to Payscale, the average salary for financial coaches in the USA is about $50,000 per year, with potential for higher earnings based on experience and clientele.

Can I work as a financial coach online?

Yes, many financial coaches operate online, offering virtual consultations and coaching sessions, making it a flexible option for both coaches and clients.

What are the common challenges faced by financial coaches?

Common challenges include acquiring clients, managing their expectations, and dealing with clients’ different levels of financial literacy.

Is financial coaching a lucrative career?

Yes, with the growing demand for financial literacy and guidance, a career in financial coaching can be lucrative, especially with effective marketing and a strong client base.

Conclusion

Becoming a financial coach can be a rewarding career choice for those passionate about helping others achieve financial freedom. By following the steps outlined in this guide, continuously improving your knowledge, and effectively marketing your services, you can build a successful and fulfilling practice. Are you ready to take the plunge into this exciting field?

For further reading and credible sources on finance coaching, check out: