In today’s fast-paced world, achieving financial stability can often feel like a daunting task. Many individuals and families find themselves grappling with debt, budgeting challenges, and a lack of savings. Enter Dave Ramsey Financial Coaching, a program designed to guide you through the complexities of personal finance with clarity and support. In this comprehensive guide, we’ll delve into the principles behind Dave Ramsey’s coaching, its effectiveness, and how you can implement these strategies in your life.

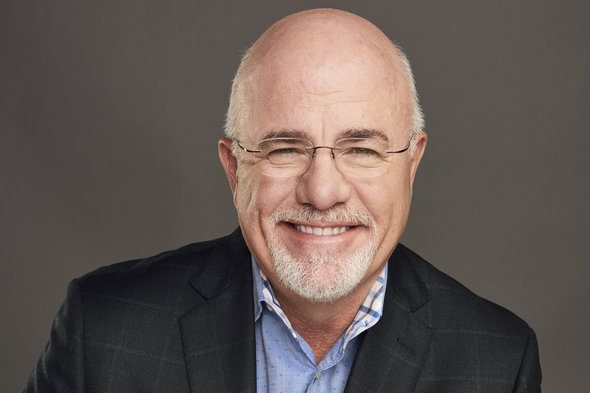

Who is Dave Ramsey?

Dave Ramsey is a personal finance expert, radio show host, and author of several best-selling books, including “The Total Money Makeover.” With over 25 years of experience, he has helped millions of people achieve financial freedom.

Core Principles of Dave Ramsey Financial Coaching

At the heart of Dave Ramsey’s coaching lies a set of core principles designed to simplify financial management and empower individuals. Let’s explore these principles:

1. The Baby Steps

Dave Ramsey’s famous Baby Steps outline a clear path to financial peace.

- Baby Step 1: Save $1,000 for a starter emergency fund.

- Baby Step 2: Pay off all debt using the debt snowball method.

- Baby Step 3: Save 3-6 months of expenses in an emergency fund.

- Baby Step 4: Invest 15% of your household income into retirement.

- Baby Step 5: Save for your children’s college fund.

- Baby Step 6: Pay off your home early.

- Baby Step 7: Build wealth and give.

2. The Debt Snowball Method

This method involves paying off debts from the smallest to the largest, providing quick wins and motivation.

3. Creating a Budget

A monthly budget is essential for tracking your income and expenses. Ramsey emphasizes the importance of a zero-based budget, where every dollar is assigned a specific purpose.

4. Emergency Fund

Having an emergency fund is crucial for financial stability. Ramsey recommends aiming for at least three to six months of living expenses.

Advantages of Dave Ramsey Financial Coaching

Choosing Dave Ramsey’s financial coaching comes with several benefits:

1. Practical Framework

The structured approach of the Baby Steps makes it easy for individuals to follow a clear path to financial health.

2. Community Support

Joining a Ramsey Group connects you with a community of like-minded individuals who provide encouragement and accountability.

3. Proven Success

Many testimonials highlight the effectiveness of Ramsey’s teachings in transforming financial lives.

Challenges and Considerations

While Dave Ramsey’s coaching has many positives, it’s also essential to consider some challenges:

1. Rigid Approach

Some may find the Baby Steps too rigid for their financial situations, especially in the face of varying economic conditions.

2. Limited Investment Strategies

Ramsey’s focus on specific types of investments may not align with everyone’s financial goals.

How to Get Started with Dave Ramsey Financial Coaching

1. Explore Resources

Visit Dave Ramsey’s official website for a wealth of resources.

2. Attending Financial Peace University

Consider enrolling in Financial Peace University (FPU), an online course that offers a deeper understanding of personal finance principles.

3. One-on-One Coaching

If you prefer personalized guidance, seek out a certified Ramsey coach for one-on-one coaching sessions.

Cost of Dave Ramsey Financial Coaching

The cost of using Dave Ramsey’s coaching resources can vary. Here’s a breakdown:

| Resource | Price | Description |

|---|---|---|

| Financial Peace University | $129.99 | Comprehensive course covering the Baby Steps. |

| Books | $20 – $30 | Various books on personal finance. |

| One-on-One Coaching | $100 – $300 per session | Personalized financial coaching. |

Success Stories: Real-Life Transformations

A multitude of success stories showcases how individuals and families have transformed their financial lives by following Ramsey’s principles. For instance:

Testimonial Example

“Following Dave’s Baby Steps transformed our lives. We paid off $50,000 in debt in just 18 months, and now we’re on track for retirement!” – Sarah M., Ohio

FAQs about Dave Ramsey Financial Coaching

1. What is Financial Peace University?

Financial Peace University (FPU) is a nine-lesson course that teaches participants how to manage money effectively, eliminate debt, and build wealth.

2. How much debt can I expect to pay off with Dave Ramsey coaching?

Results vary, but many individuals report paying off thousands of dollars in debt within a year using the debt snowball method.

3. Is Dave Ramsey financial coaching suitable for everyone?

While many benefit from Ramsey’s teachings, it’s essential to evaluate whether his methods align with your unique financial situation.

4. Are there any free resources available?

Yes! The Dave Ramsey blog offers numerous free articles and resources on personal finance topics.

Conclusion

Dave Ramsey financial coaching offers a structured approach to achieving financial peace and wellness. Whether you’re drowning in debt, looking to budget better, or aiming to build wealth, Ramsey’s principles can guide you toward your financial goals. By leveraging the resources available, including Financial Peace University and personalized coaching, you can take control of your financial destiny.