The fashion industry is constantly evolving, and so is the stock market. For investors who keep a keen eye on luxury fashion brands, Coach Inc (now known as Tapestry, Inc.) offers an intriguing case study. In this article, we will explore the share price performance of Coach Inc, the factors influencing its market value, and what potential investors need to know.

Overview of Coach Inc (Tapestry, Inc.)

Founded in 1941 in New York City, Coach has grown into a global leader in the luxury accessories market. The company rebranded itself as Tapestry, Inc. in 2017 to reflect its diverse portfolio, which includes brands like Kate Spade and Stuart Weitzman. Understanding the share price of Tapestry, Inc. requires a closer look at several factors that influence its stock performance.

Key Factors Influencing Share Price

- Financial Performance: Revenue and earnings reports significantly affect share prices.

- Market Trends: Changes in consumer behavior and preferences can sway stock valuations.

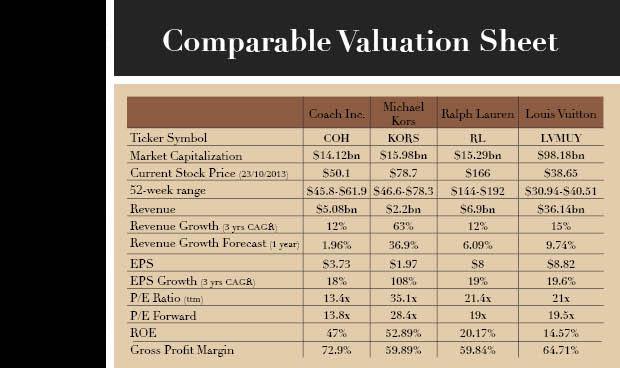

- Competitive Landscape: Performance relative to competitors like LVMH and Gucci.

- Economic Indicators: Inflation rates, consumer spending, and international trade policies impact luxury goods sales.

Analyzing the Share Price of Coach Inc

Historical Share Price Trends

The share price of Coach, now Tapestry, Inc., has seen various fluctuations since its IPO. Here’s a brief overview of its historical performance:

| Year | Share Price Range | Notable Events |

|---|---|---|

| 2017 | $40 – $50 | Rebranding to Tapestry, Inc. |

| 2018 | $35 – $55 | Acquisition of Kate Spade |

| 2019 | $25 – $40 | Stock market volatility |

| 2020 | $10 – $30 | Pandemic impact |

| 2021 | $20 – $40 | Recovery phase |

| 2022 | $30 – $45 | Strong earnings report |

| 2023 | $25 – $40 (Projected) | Market correction |

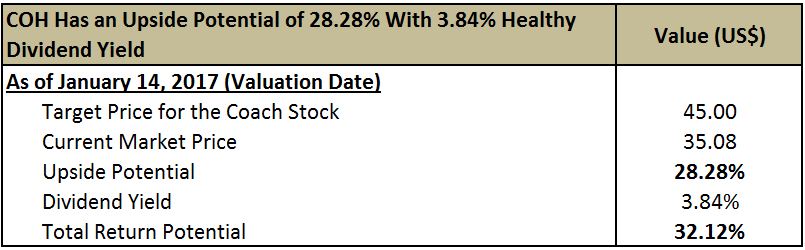

Current Share Price Performance

As of recent trading sessions, Tapestry, Inc. has a share price hovering around $35. This figure can fluctuate due to macroeconomic developments and company-specific news. For the latest updates, investors should check reliable financial news platforms or the official Tapestry website.

Share Price Comparison with Competitors

| Company | Current Share Price | Market Capitalization | 1-Year Performance |

|---|---|---|---|

| Tapestry, Inc. (Coach Inc) | $35 | $9.5 Billion | -10% |

| LVMH | $680 | $320 Billion | +5% |

| Gucci (Kering) | $540 | $64 Billion | -5% |

Investing in Tapestry, Inc.: Pros and Cons

Pros

- Diverse Brand Portfolio: Tapestry offers various luxury brands, reducing risk.

- Strong Recovery Potential: Post-pandemic recovery shows promising sales growth.

- Solid Dividend History: Regular dividends may appeal to income-focused investors.

Cons

- Uncertain Economic Landscape: Luxury goods are sensitive to economic downturns.

- High Competition: Competing with major players can impact market share.

- Stock Volatility: Fluctuations can deter risk-averse investors.

Investment Tips for Buying Tapestry Inc Shares

1. Research Market Trends

Stay updated with the latest trends in the luxury market. Follow reports by organizations like Bain & Company, which often publish insights on consumer behavior in luxury markets.

2. Analyze Financial Statements

Review Tapestry’s quarterly earnings, balance sheet, and income statement to gauge its financial health. Websites like SEC.gov provide access to filings.

3. Consider Long-Term vs Short-Term Investment

Determine your investment strategy—whether you’re looking for a long-term hold or short-term gains. Tapestry’s stock may exhibit short-term volatility but show potential for long-term growth.

4. Diversify Your Portfolio

Don’t put all your eggs in one basket. Include a mix of different sectors to minimize risk.

5. Consult with Financial Advisors

If you are new to investing, consider seeking advice from financial professionals for personalized strategies.

Frequently Asked Questions about Coach Inc Share Price

What influences Coach Inc’s share price?

Several factors, including financial performance, market trends, competition, and economic indicators, influence the share price of Tapestry, Inc.

Is Tapestry, Inc. a good investment?

Investing in Tapestry has its risks and rewards. It’s essential to evaluate market conditions, company performance, and personal investment goals.

How can I stay updated on Coach Inc’s stock performance?

You can follow financial news websites, check stock market apps, and subscribe to newsletters for real-time updates on Tapestry, Inc.’s stock performance.

Where can I find reliable financial reports for Coach Inc?

For accurate financial reports, visit the Tapestry, Inc. Investor Relations page or the SEC website.

Conclusion

In conclusion, understanding the share price of Coach Inc, or Tapestry, Inc., involves more than just looking at numbers. It requires an analysis of market trends, financial performance, and an understanding of the broader economic landscape. As an investor, it’s crucial to equip yourself with the right information and strategies. With the luxury market’s potential for recovery and growth, Tapestry, Inc. may offer lucrative opportunities for savvy investors. However, always proceed with caution and due diligence.