In today’s fast-paced world, managing finances can often feel overwhelming. Whether it’s dealing with debt, planning for retirement, or just trying to make ends meet, financial coaching has emerged as a valuable resource. This article aims to demystify financial coaching, how to find it near you, and why it could be the key to your financial wellness.

What is Financial Coaching?

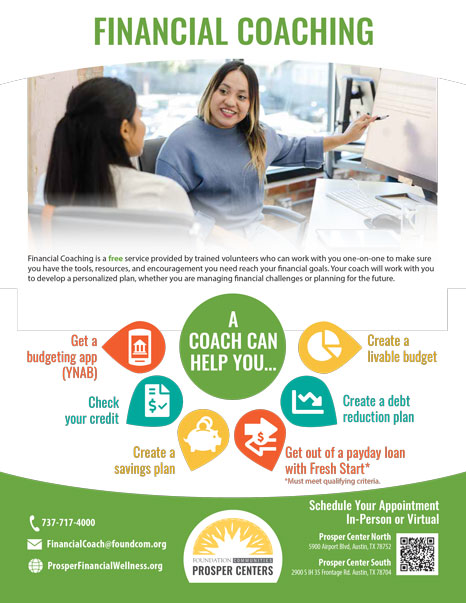

Financial coaching is a process aimed at helping clients understand their financial situations and improve their financial health. Unlike traditional financial advising, which often focuses on investments and wealth management, financial coaching emphasizes personal finance skills and strategies.

Key Benefits of Financial Coaching

- Improved budgeting skills

- Greater financial literacy

- Personalized financial plans

- Accountability and support

Common Financial Coaching Services Offered

Financial coaches provide a variety of services designed to help clients take control of their finances. Some of the most common services include:

Budgeting and Expense Tracking

Creating a budget and tracking expenses can help you make informed decisions about your spending.

Debt Management Strategies

Coaches help clients develop strategies to pay down debts and improve credit scores.

Investment Education

Some coaches offer basic investment education to help clients understand their options.

Retirement Planning

Financial coaches can assist in developing a savings plan for retirement.

Finding Financial Coaching Near You

Finding the right financial coach is crucial for your success. Here are several avenues to explore when searching for coaches nearby.

Online Directories and Platforms

Utilize platforms like NFCC (National Foundation for Credit Counseling) or BrightScope to locate certified financial coaches in your area.

Local Community Centers and Nonprofits

Many community centers and nonprofits offer financial coaching services, often at little to no cost. Check local resources like USA.gov for information on local organizations.

Word of Mouth and Recommendations

Ask friends, family, or colleagues if they have recommendations for financial coaches in your area. Personal experiences can lead to quality connections.

How to Choose the Right Financial Coach

Once you’ve identified potential coaches, the next step is making sure you choose the right one. Here are some factors to consider:

Check Credentials and Experience

Look for coaches with relevant certifications, such as Certified Financial Planner (CFP) or Accredited Financial Counselor (AFC).

Specializations

Different coaches may specialize in various areas such as debt management, retirement planning, or budgeting. Make sure their specialization aligns with your needs.

Approach and Philosophy

Every coach has a unique coaching style. Schedule an initial consultation to see if their approach resonates with you.

Comparative Analysis of Financial Coaching Services

| Service | Pros | Cons |

|---|---|---|

| Debt Management | Effective for reducing debt, personalized strategies | May require time and commitment |

| Budgeting Advice | Helps create sustainable financial habits | Requires ongoing discipline and adjustments |

| Retirement Planning | Provides clarity on long-term goals | Markets can be unpredictable, affecting plans |

Cost of Financial Coaching Services

The cost of financial coaching varies significantly based on the coach’s experience, location, and specific services offered. Here is a rough breakdown:

- Hourly Rate: $50 – $300

- Monthly Retainer: $200 – $1,500

- Project-Based Fee: $500 – $5,000 or more

Are There Free Resources Available?

Many nonprofit organizations provide free financial coaching. Look into resources such as the Consumer Financial Protection Bureau for free educational materials and workshops.

Tips for Maximizing Your Financial Coaching Experience

- Be honest about your financial situation.

- Set clear goals to discuss with your coach.

- Stay engaged and follow through on recommendations.

- Leave room for adjustments as your financial situation evolves.

FAQs About Financial Coaching Near Me

What qualifications should I look for in a financial coach?

Look for coaches with certifications such as Certified Financial Planner (CFP), Accredited Financial Counselor (AFC), or similar credentials. Experience in areas relevant to your needs is also important.

How long does financial coaching typically last?

The duration of coaching depends on your financial goals. Some clients see significant improvements in a few sessions, while others may require ongoing support over months or even years.

Is financial coaching worth the investment?

Many clients find that the skills and insights gained from coaching lead to substantial financial improvements, making the investment worthwhile.

Conclusion

Finding financial coaching near you can be a transformative step towards financial stability and growth. By considering your needs, doing thorough research, and being open to guidance, you can take control of your financial future. Remember, the journey to financial wellness is a marathon, not a sprint. With the right coach, you’re well on your way to achieving your monetary goals!

For additional reading and resources, check out these studies: