In today’s fast-paced financial world, many people seek guidance to manage their money effectively. Among the leading voices in personal finance is Dave Ramsey, a renowned financial expert who offers coaching and resources designed to help individuals and families regain control of their financial futures. This article delves into the principles of Dave Ramsey’s financial coaching, the steps involved, the pros and cons, and how you can apply these strategies in your own life.

Who is Dave Ramsey?

Dave Ramsey is an American financial author, radio host, and motivational speaker, known for his no-nonsense approach to personal finance. With over 30 years of experience in the financial field, he has authored several best-selling books, including The Total Money Makeover, and hosts a popular radio show and podcast. His teachings primarily focus on debt reduction, budgeting, and building wealth.

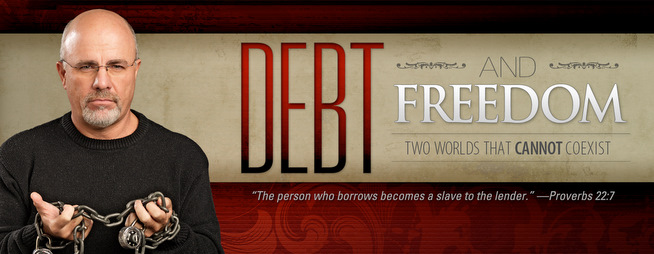

A Brief History of Dave Ramsey

Dave’s journey began when he was in his early twenties and faced substantial financial difficulties after being deeply in debt. After declaring bankruptcy, he dedicated himself to understanding financial principles and developing a practical guide for others facing similar situations. His experiences and insights created the foundation for his financial coaching philosophy.

The Basics of Dave Ramsey’s Financial Coaching

Dave Ramsey’s financial coaching is rooted in a series of steps known as the Seven Baby Steps. These steps are designed to guide individuals toward financial peace and security.

The Seven Baby Steps

| Baby Step | Description | Goal |

|---|---|---|

| 1 | Save $1,000 for a starter emergency fund. | Prepare for unexpected expenses. |

| 2 | Pay off all debt using the debt snowball method. | Become debt-free faster. |

| 3 | Save 3 to 6 months of expenses for a full emergency fund. | Secure your financial future. |

| 4 | Invest 15% of household income into retirement. | Build wealth for the future. |

| 5 | Save for your children’s college fund. | Prepare for educational expenses. |

| 6 | Pay off your home early. | Reduce overall financial burden. |

| 7 | Build wealth and give generously. | Achieve financial freedom and help others. |

Benefits of Dave Ramsey’s Financial Coaching

Many individuals have found success through Dave Ramsey’s financial coaching. Here are some key benefits:

Comprehensive Financial Education

Dave provides a wealth of resources that cover various aspects of personal finance, including budgeting, saving, investing, and retirement planning. His educational materials empower individuals to make informed financial decisions.

Encouragement for Accountability

The coaching program emphasizes accountability, encouraging participants to track their progress and celebrate milestones. This sense of community and support can be highly motivating.

Proven Track Record

With millions of followers and numerous success stories, Ramsey’s methods have demonstrated effectiveness in helping people achieve financial stability and independence.

Challenges and Critiques of the Ramsey Method

While many find success with Dave Ramsey’s principles, there are also critiques and challenges associated with his approach.

Overly Simplistic Strategies

Some critics argue that the Baby Steps oversimplify complex financial situations. Not everyone fits neatly into the proposed steps, and individual circumstances may require a more tailored approach.

Debt Snowball vs. Debt Avalanche

The debt snowball method, which focuses on paying off smaller debts first for emotional wins, is favored by Ramsey. However, others advocate for the debt avalanche method, which prioritizes higher-interest debt to save money in the long run. Each method has its pros and cons, and individuals must choose what works best for them.

Financial Flexibility

Some followers find Ramsey’s strict budgeting rules too restrictive. Life can present unexpected situations that require adaptability in financial planning, and rigid adherence to a specific method may not always be feasible.

How to Start with Dave Ramsey Financial Coaching

If you’re inspired to take control of your financial future through Dave Ramsey’s coaching, here’s how to get started:

Utilize Online Resources

Dave Ramsey’s website offers a variety of free tools, articles, and podcasts that can help you begin your journey. Notably, the Financial Peace University online course is an excellent place to start.

Join a Local Group

Many communities have local groups dedicated to Dave Ramsey’s teachings. Joining one can provide support, accountability, and encouragement along your financial journey.

Attend Financial Peace University Classes

This 9-week course dives deep into financial principles and provides actionable steps toward financial freedom. Classes are available both online and in-person at various locations across the United States.

One-on-One Financial Coaching

If you’re looking for personalized guidance, you might consider hiring a certified Ramsey Solutions Financial Coach. These coaches can tailor strategies to fit your unique financial circumstances.

Comparison of Financial Coaching Options

When choosing a financial coaching program, it’s essential to compare different options. Below is a comparison of various financial coaching methods, including Dave Ramsey’s approach:

| Coaching Method | Focus Area | Style | Cost |

|---|---|---|---|

| Dave Ramsey Financial Coaching | Debt reduction & wealth building | Structured, step-by-step | Varies (Courses approx. $129) |

| Financial Advisors | Investment & retirement planning | Personalized, comprehensive | Fees based on assets |

| Online Financial Courses | General financial literacy | Flexible, self-paced | $50-$300 |

| Debt Management Agencies | Debt negotiation | Advisory, reactive | Fees & % of debt |

Practical Tips for Applying Ramsey’s Principles

- Create a Detailed Budget: Start tracking your income and expenses. Use budgeting apps or spreadsheets to stay organized.

- Follow the Baby Steps Religiously: Stick to the Baby Steps to achieve financial goals step-by-step.

- Automate Savings: Set up automatic transfers to your savings account to ensure you’re always saving.

- Celebrate Small Wins: Acknowledge your financial milestones to stay motivated.

- Stay Educated: Continue to learn about personal finance through books, podcasts, and seminars.

Frequently Asked Questions (FAQs)

What is the primary philosophy behind Dave Ramsey’s financial coaching?

Dave Ramsey emphasizes debt reduction, budgeting, and wealth building through structured steps known as the Seven Baby Steps. He believes in living within your means and preparing for future financial needs.

Is Dave Ramsey’s financial coaching suitable for everyone?

While many find success with Ramsey’s methods, individuals with complex financial situations or unique needs may require a more tailored approach.

How much does Financial Peace University cost?

The course typically costs around $129 for the online version, providing comprehensive financial education and tools.

Conclusion: Step Toward Financial Freedom

Dave Ramsey’s financial coaching offers a structured path for those looking to manage their finances effectively. By following his principles, you can reduce debt, save more, and ultimately achieve financial freedom. Whether you’re struggling with debt or simply want to enhance your financial literacy, exploring Dave’s coaching may be an invaluable step toward a more secure financial future.